Mortgage Default Services

Our counselors can guide you in determining what options are available for direct assistance to prevent mortgage foreclosure or in navigating your mortgage servicer’s application for mortgage assistance. The most important first step is always to communicate with the mortgage servicer immediately, at the first sign that you are about to fall behind with your mortgage payments or if you are already one or more months behind. DO NOT WAIT to contact your mortgage servicer to find out what assistance is available and how to apply for it. Once you are connected with a HUD-certified counselor, they can provide guidance wherever you are in that process and also connect you to any other assistance that may be available.

Property Tax Foreclosure Services

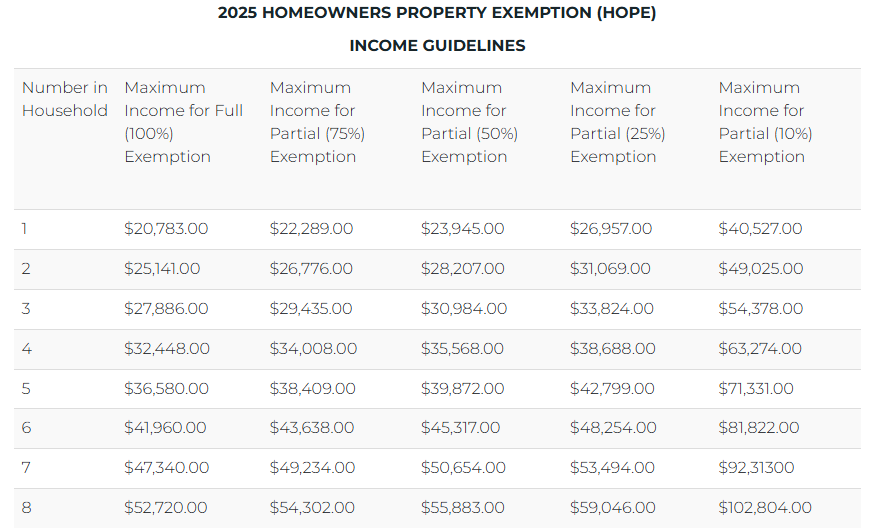

If you an owner/occupant of a home and live in the City of Detroit, you may be eligible for the Homeowner Property Exemption (HOPE). This is an annual property tax exemption that income-eligible owner/occupants can apply for. Our team can help you complete and submit this application to the Board of Review at the City of Detroit. Please see the table below for the income guidelines.

We must have ALL documents before the appointment. Here is the list of required documents needed:

- Registered proof of ownership (Deed, land contract, probate court order, divorce judgment etc.)

- Any form of government ID with address and picture of the homeowner and all residents over the age of 18

- Proof of income for ALL members of the household (this includes any minor children). Examples: W2’s, paystubs, SSI/SSD, pension FIA/DHS, child support, self-employment, signed and notarized letter from who is helping you financially, etc.

- Previous years Federal and State tax returns for all adults, if filed (if are not required to file a tax return, the adult must complete a Michigan Treasury Form 4988 Poverty Exemption Affidavit and IRS 4506-T and can provide W2’s, social security statements, or any other document that proves the past year’s income)

- Proof of residency for all minors in the household (such as FIA Statement, Report Card, Transcript, minor listed on tax return, etc.)

How do I get started?

Please read the instructions: How to set up your My Home account.

Create your account within our My Home website portal to access our counselors and services. Go to the Home Preservation dropdown menu to choose either the property tax or mortgage foreclosure prevention service option. The My Home system will ask you to provide some basic information to allow counselors to help you.

*Be sure to fill in all information fields when prompted to enable the start of service*

Previous Fiscal Year Results

In 2024, we helped Detroit Homeowners apply for the Homeowners Property Exemption (HOPE).