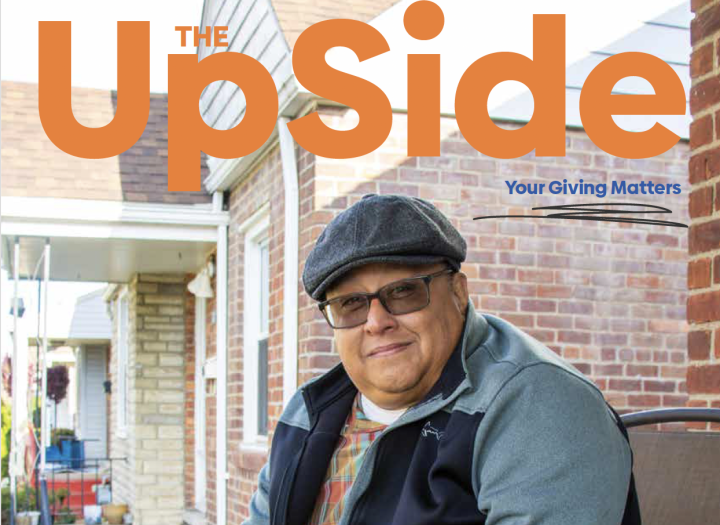

Rev. Larry Smith at his home on Detroit's east side.

Redeeming His Life And His Family Home: Larry's Story

Larry Smith clung to the hope that he would return home, though he knew it would take an unlikely act of mercy.

Home is a house on the east side where he grew up. Larry was one of nine children. And the oldest. His father worked in an auto plant to provide the family a place of their own. When his parents passed away, Larry inherited the home, although he could not occupy it himself.

Larry was serving a life sentence without the possibility of parole.

Larry was 24 years old when he went to prison in 1978. He was convicted of conspiracy to commit first-degree murder. He committed the felony when he was 21.

“We lived in a gang-infested neighborhood, and I was part of a gang, and when you run with wolves, you learn to howl,” Larry said. “Our gang killed a drug dealer. I didn’t pull the trigger, but I was part of taking a human life, and I live with that every day.”

Before his incarceration, Larry was nearly illiterate, with an education level around sixth grade. In prison, he obtained his High School Equivalency. He devoted himself to Bible studies, enrolled in a Bible institute and earned a degree, eventually becoming an ordained minister.

Larry also connected with the Chance for Life program, which trains inmates in leadership, mediation and communication skills. He became determined to give back to the community, raising money for shelters, food pantries, and programs that provide winter coats and school supplies to kids in need.

“I grew up in prison, became a changed person, and thought I would die in prison,” Larry said. “When you are confined to a cell, you have so much time to think about all the things you did wrong and how to make your life right.”

Because of Larry’s repentant and redemptive journey in prison, people familiar with his good works advocated for his clemency. They petitioned Governor Rick Snyder to commute Larry’s sentence. In the spring of 2019, his last year in office, the Governor granted the petition. After more than 40 years behind bars, Larry was a free man. And homeward bound.

The family home he inherited was occupied by relatives who neglected its upkeep and various bills, including the property taxes. When Larry took possession, the home was facing foreclosure, with nearly $5,000 in back taxes and penalties owed. Larry’s only income was his social security, and he had no way himself to clear up the debt.

“The home has great sentimental value, and I didn’t want to lose it and disappoint the memory of my parents,” Larry said. “I was also very stressed because without a place to live, I’d be homeless.”

Larry asked around for help, and he was referred to Southwest Solutions’ Homeownership Assistance Team. At the beginning of this year, Larry began working with Cynthia McCreary, Housing Stability Counselor.

First, Cynthia helped Larry file the 2021 Homeowner Property Exemption (HOPE) application and all its required documents with the City of Detroit. The HOPE reduces or eliminates the current year’s property tax bill for eligible homeowners. Because of Covid protocols, Cynthia needed to communicate with Larry via Zoom. However, Larry’s digital literacy skills, given that he had been removed from society for four decades, were not sufficient. So Cynthia helped Larry improve those skills to proceed.

Larry qualified for the HOPE because of his limited income and assets. With the HOPE in hand, Cynthia helped Larry apply for the Pay as You Stay (PAYS) program. PAYS helps Michigan homeowners who have fallen behind on their property taxes stay in their homes. It provides affordable payment plans and eliminates penalties, interest and fees for eligible homeowners. Under PAYS, homeowners pay only their back taxes or 10 percent of the home’s taxable value, whichever is less.

Larry’s PAYS’ settlement to resolve all his back taxes was about $1,100. Cynthia then helped him apply for the Detroit Tax Relief Fund, which can wipe out back taxes for Detroit homeowners who qualify for the HOPE and PAYS. The Fund is made possible through a generous donation by the Gilbert Family Foundation. It paid off Larry’s $1,100 PAYS amount.

“I was so excited and relieved for Larry to get his family home free and clear of debt, and he no longer had to worry about losing it and where he would go on his limited income,” Cynthia said.

The Southwest Solutions’ Homeownership Assistance Team (HAT) has helped more than 200 Detroit homeowners secure property tax exemptions in the two years before this one. Each of those homeowners then became eligible for PAYS and the Detroit Tax Relief Fund. The deadline to file for the exemption this year is December 13.

“We strongly encourage all Detroit homeowners who are struggling to pay their property taxes to take advantage of this program so they can keep their homes, like Larry,” said Alex Makohn, Manager of Southwest Solutions’ HAT.

Larry is now focused on making needed improvements to his home. He will be applying for home repair loans and grants available to low-income homeowners.

“I came from a good home and I want it to be a good home again,” Larry said.